Welcome to Part 2 of Thinking About Retirement. If you missed Part 1, you can read it here.

In this part we are going to cover what is the CalPERS retirement plan, when you are eligible for retirement, calculating your retirement benefit, and the best time to retire.

The CalPERS Retirement Plan

CalPERS is a defined benefit plan funded by employee contributions, employer contributions, and earnings made on CalPERS investments. Most employees contribute a percentage of their salary, which accrues interest under their individual CalPERS account.

As a member, you may choose to withdraw your contributions and interest if you no longer work for a CalPERS covered employer, or you may apply for a lifetime monthly retirement allowance once you become eligible.

Retirement Eligibility

You may apply for a service retirement when you have at least 5 years of CalPERS service credit and meet the minimum age requirement. If you became a member prior to January 1, 2013, in most cases you must be at least age 50. If you became a member on or after January 1, 2013, you must be at least age 52.

Why the difference? It was because of the Public Employees Pension Reform Act … because you all know public employees retire rich in California and need our benefits to be downsized! It was a big political thing. You are considered a “Classic” member if you were a member before January 1, 2013. Anyone after that is considered to be a PEPRA member. You can find more information about PEPRA here.

The benefit difference between a Classic member and a PEPRA member is actually quite stunning. The biggest things are the retirement benefit factor and compensation limits. You will read more about these later in this article.

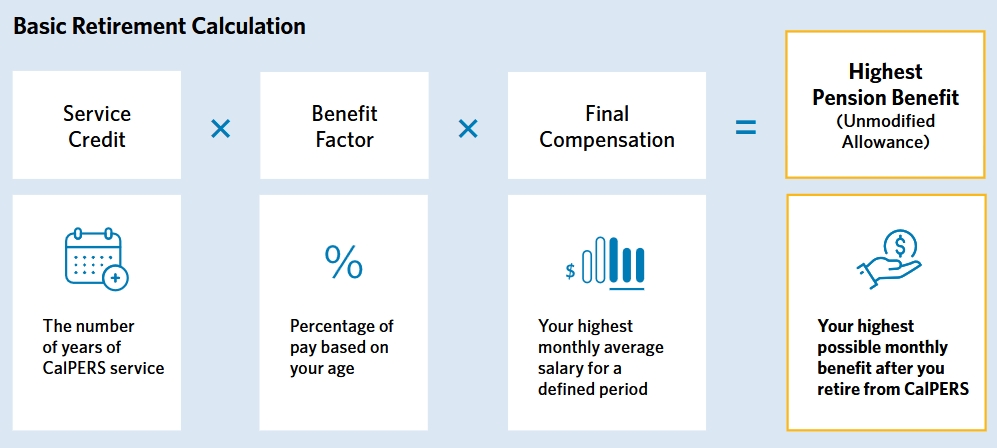

Calculating Your Retirement Benefit

The key to increasing your retirement benefit is to understand how your service credit (years of service), benefit factor (age factor), and final compensation (highest average salary) are used in the basic retirement calculation. Increase any one of these factors and you will increase your overall benefit, called the Unmodified Allowance.

If you have more than one retirement formula, CalPERS will calculate an Unmodified Allowance for each formula and then add them to get your total Unmodified Allowance. For example, you might have worked for two cities, one had 2.5% at 55 and the other had 2.7% at 55. CalPERS will do the calculation for each and add them together.

Service Credit

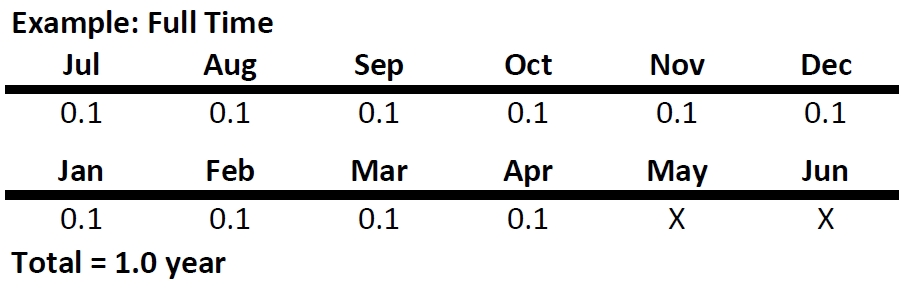

Service credit is the first of three factors used in calculating your retirement pension. Service credit is the number of years, including partial years, you have worked and contributed to CalPERS.

Service credit accumulates on a fiscal year basis from July 1 through June 30. Starting in July, if you work full time, you will earn one tenth of a year by the end of July. You earn another tenth each month until the end of April, when you will hit one year.

In May and June you will not earn any more service credit because you cannot earn more than one year of service credit in a fiscal year. Do note that if you begin working in the middle of a fiscal year, you would continue to earn service credit in May and June, then in the new fiscal year you would sync up for the 10 months from July to April.

Work 10 months to earn 1 year of service credit? What a deal! This is why some members retire in the months of May and June. Do note that if you work part time it will take you longer to earn one year. Part time employees earn 0.05 years of service each month with a total of 0.6 year each fiscal year.

You can view your current service credit at any time by logging in to myCalPERS at my.calpers.ca.gov or by referring to your CalPERS Annual Member Statement to verify your service credit total.

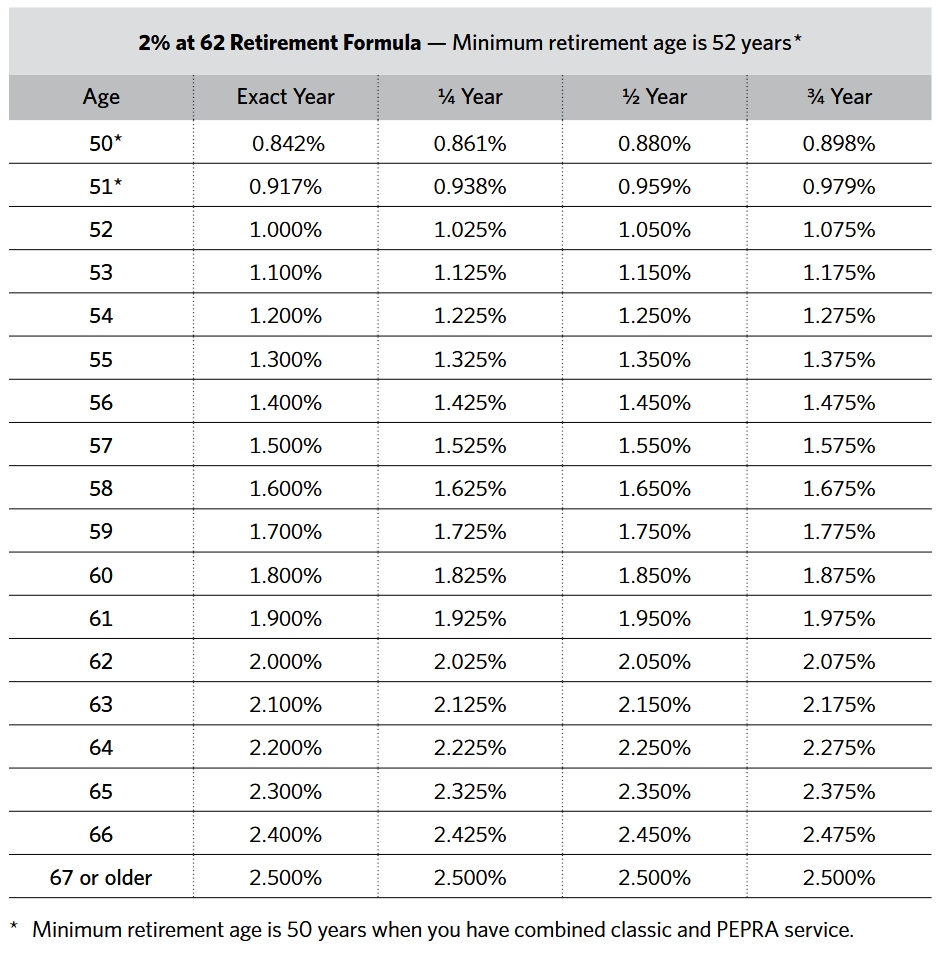

Benefit Factor

The benefit factor is the second of three factors used in calculating your retirement pension. Your benefit factor, sometimes called “age factor,” is the percentage of pay you are entitled to for each year of CalPERS covered service. It is determined by your age at retirement and your retirement formula. The benefit factor changes for every quarter year of age (every 3 months) based on your birthday. For example, if your birthday is March 10, your birthday quarters are:

Birthday: March 10

¼ year: June 10

½ year: September 10

¾ year: December 10

At Burbank for local miscellaneous members, a Classic member has a retirement formula set at 2.5% at 55, while a PEPRA member is set at 2% at 62.

Starting at your minimum retirement age, your benefit factor increases every quarter year up to a maximum age. For example, if your retirement formula is 2.5% at 55 and you retire at age 55 or older, you will get 2.5% for each year of service credit. Note that if a PEPRA member waits until age 67 or older to retire, they will get 2.5% as well.

You can visit the benefit factor charts here. Look under Local Miscellaneous Member. Note that the second page of the charts will show you your percentage of final compensation based on your age and years of service. Your percentage of final compensation goes up the older you get and the more years of service you have.

Final Compensation

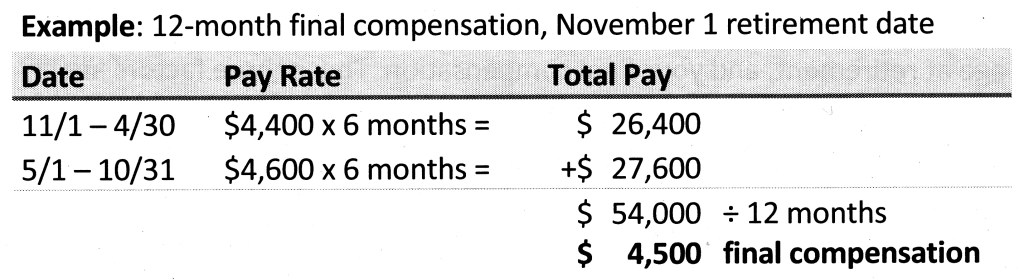

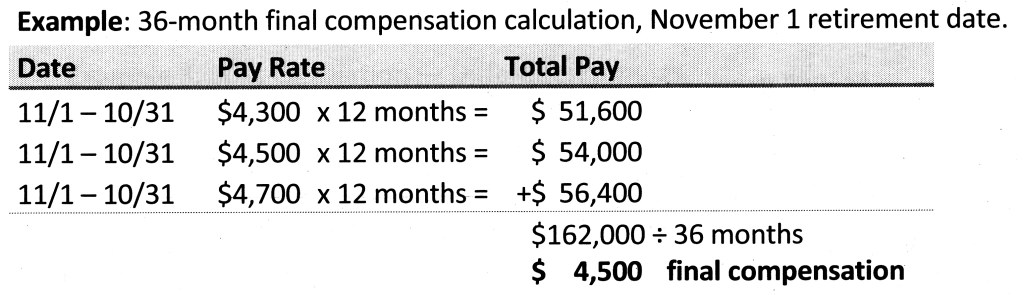

Final compensation is the third of the three factors used in calculating your retirement. Your final compensation is your highest average annual compensation earnable during any consecutive 12-month or 36-month period of employment. CalPERS uses your full time pay rate, not your actual earnings. Even if you work part time, your full time equivalent pay rate is used, however you are earning less service credit.

Special compensation, pay that may be reported in addition to your base pay rate, may include payment received by you for special skills, knowledge, or work assignments. Burbank must contract with CalPERS to have special compensation included in your final compensation calculation. You should check with the Burbank Benefits office to find out what is being reported on your behalf.

If you became a member before January 1, 2023, most likely you have the 12-month final compensation period. If you became a member on or after January 1, 2023, your final compensation period is 36-months. If you are unsure which you have, you can check with the Benefits office and find out.

Here are two examples of monthly final compensation calculations:

Be aware there are set compensation limits, which limits the amount of compensation that can be considered under your defined benefit plan. A Classic member this year is $350,000, while a PEPRA member is $186,096 (non-Social Security). If your compensation goes above these limits, your contributions and Burbank’s contributions to CalPERS stops for the rest of the year. Employees with membership dates before July 1, 1996 are not impacted by these limits.

Compensation limits do not place a limit on what you can earn. It only places a limit on what compensation can be used for your retirement calculation. For example, if you are a PEPRA member making $195,000 a year for 3 years and will retire in 2025, only $186,096 ($15,508 final compensation) will be used in your retirement calculation.

Here is a tip, once your contributions to CalPERS stop, consider putting those contributions into another savings vehicle toward your retirement goals, like a Roth IRA for tax free growth.

You can find more information on compensation limits here.

One more thing. If you paid into Social Security while under CalPERS at another employer (Burbank does not contribute to Social Security), a one-time offset of $133.33 will be made to your final compensation before your retirement benefit is calculated. This is called the Social Security offset. For example, $4,500 – $133.33 = $4,366.67. This is because you did not pay CalPERS contributions on your full earnings, therefore not all earnings are used in your calculation. This is a one-time adjustment to the final compensation used in your retirement calculation, not a monthly reduction to your retirement check.

Your Retirement Calculation

So let’s bring this all together. Let’s say you have 25 years of service credit in CalPERS, you are 60 and are in the 2.5% at 55 retirement formula so your benefit factor is 2.5%, and your final compensation is $10,000 per month. The math goes like this:

Service Credit x Benefit Factor x Final Compensation

25 x 2.5% (0.025) x 10,000 = 6,250

Your highest pension benefit or Unmodified Allowance will be $6,250. Let’s say you decide to wait 5 more years, but your pay stays the same.

30 x 0.025 x 10,000 = 7,500

$7,500 is much better! Maybe you will stick around for another 5 years! If your pay goes up during that time, then your Unmodified Allowance will go up even higher.

Keep in mind that your Unmodified Allowance represents the highest pension benefit you can receive for retirement. Most likely you will include a benefit for your beneficiary, which will decrease your pension benefit depending on which retirement payment option you choose. I will write more about this soon.

CalPERS has a wonderful Retirement Estimate Calculator that you can use to try out different scenarios. This will help you plan on when the best time to retire would be for you. You can check out the calculator here.

If you login to myCalPERS, you can run the calculator and save your results for future reference as well. If you are within one year of your expected retirement date, you can submit the Retirement Allowance Estimate Request form to CalPERS and they will use your current account information to project your benefit as of your estimated retirement date. You are allowed up to two CalPERS generated estimates in a 12 month period. I found the estimate to be very close to what I actually received for retirement, within + or – $50.

The Best Time to Retire

As with everything else, the best time to retire depends on your situation. Whatever you decide will be the best time for you. There are a couple of things to know about retirement in CalPERS that might influence your decision on when to retire.

The first we touched on earlier, and that was you earn 1 year of service credit in 10 months in a fiscal year. In the months of May and June you are not earning more service credit, so maybe that time is a good time for you to retire because you hit your goal of X number of years of service.

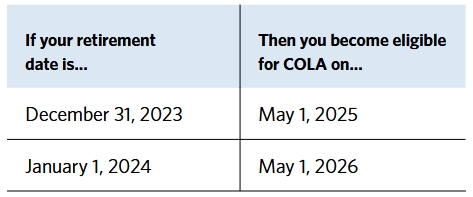

The other would be CalPERS Cost-of-Living Adjustment (COLA). Your retirement date affects how soon you can receive a COLA increase. You are eligible to receive your first COLA on May 1 of the second calendar year after your retirement year. For example:

If you retired on December 31st, you would receive your first COLA after 16 months. Wait to retire on January 1st, and you would receive your first COLA after 28 months! This might be a deciding factor for you to retire closer to the end of the year.

By the way, the COLA amount is based on three factors: Consumer Price Index (CPI) for All Urban Consumers, Burbank’s contracted COLA percentage which is 2%, and the year you retired. You can learn more about the CalPERS COLA and how you can calculate it here.

Whenever you decide to retire, remember the basics. The earlier you retire, the longer you will enjoy your retirement benefits assuming you live longer, but your monthly retirement check may be lower. The later you retire, the higher your monthly retirement check might be, but the shorter your retirement period will be if you do not live as long.

I’m going to stop here. There is so much more to write about. Part 3 will be added soon!